The Benefits of Preventive Care: Why It Matters in Your Insurance Plan

Preventive care plays a vital role in maintaining overall health. It includes services like screenings, vaccinations, and regular checkups, helping detect and prevent potential health issues early. By focusing on prevention, you can avoid expensive treatments and serious conditions down the road.

Why Preventive Care is Essential

Preventive care is designed to catch health problems before they escalate. Early detection can significantly reduce the impact of chronic diseases like diabetes or high blood pressure. Regular checkups allow healthcare providers to monitor changes in your health and recommend actions to maintain it.

Vaccinations, for instance, help you avoid illnesses like the flu or pneumonia. Screenings, like mammograms or cholesterol checks, can detect cancer or heart disease early when they are most treatable. Preventive care doesn’t just improve individual health—it reduces healthcare costs by avoiding emergency room visits and hospital stays.

Read Also: Boa Hancock Earrings: Iconic Anime Style and Symbolism

Long-Term Cost Savings

One of the main advantages of preventive care is the long-term cost savings. While regular screenings and doctor visits may seem like added expenses, they help reduce the financial burden of unexpected medical issues in the future. A simple screening can prevent costly treatments for a condition that might have gone unnoticed.

Moreover, many health insurance plans cover preventive services at no extra cost to you. This means you can access these services without worrying about additional out-of-pocket expenses, making it a smart financial decision.

How Preventive Care Supports a Healthy Lifestyle

Preventive care is more than just doctor visits. It promotes a healthier lifestyle by encouraging habits that support long-term well-being. Many preventive services include guidance on diet, exercise, and lifestyle changes to reduce the risk of chronic diseases.

For example, regular checkups might reveal high cholesterol, leading to dietary adjustments to avoid heart disease. Similarly, counseling on smoking cessation or weight loss can help prevent future health complications. When you focus on maintaining your health, you reduce your chances of developing serious medical issues later in life.

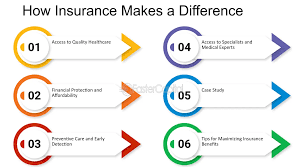

The Role of Insurance in Preventive Care

Insurance plans, especially those under the Affordable Care Act, are required to cover many preventive services. This means you can access screenings, immunizations, and counseling without additional costs. This coverage encourages individuals to seek care before health problems arise, promoting better overall health.

As you look into different insurance options, especially for upcoming plans like Marketplace health insurance 2025, make sure you understand what preventive care services are covered. Choosing a plan that offers comprehensive preventive care can protect both your health and your wallet.

Preventive Care and Public Health

Preventive care doesn’t just benefit individuals—it contributes to better public health. When more people get vaccinated or participate in regular screenings, it reduces the spread of diseases and lowers the healthcare burden on communities. This collective effort improves the overall quality of life and reduces strain on healthcare systems.

Conclusion

Preventive care is a critical part of managing your health. By taking advantage of the services covered in your insurance plan, you can maintain better health, prevent serious conditions, and save money in the long run. When choosing an insurance plan, ensure it provides access to preventive services. It’s a small step that makes a big difference in your future well-being.